Need some financial advice? Check out what folks are asking Dave Ramsey. Debt and Income Crisis? Pay off the house first? Check cashing? Taxes?

Debt and Income Crisis

Dear Dave,

I received a call the other day from a company saying it could negotiate the balance on my credit cards to a lesser amount. The caller also said they could get me a zero-percent interest rate until the debts were paid off, and then the accounts would be closed. I’m kind of starting over again financially, because I sold a company I had run for almost 15 years, then got into real estate and lost almost everything. I’m making just enough to squeeze by, and my credit card debt totals $40,000. Would this be a good idea?

Bill

Dear Bill,

No, this is not a good idea. You’re looking at two major problems with a company such as this one. One, they will absolutely destroy whatever credit you may have. Their plan is to take your cash, and spend some time beating down the credit card companies until they agree to accept a lesser amount. Then, they use your cash to settle loans you will have — by that time —defaulted on. This will put you in a situation very similar to if you had filed Chapter 13 bankruptcy. Stay away from these people.

You have an income crisis, in addition to a debt crisis, at this point. For starters, I want you to start living on a tight, written, monthly budget. I’m talking rice and beans, no vacations, and no eating out until you pay off this debt. Where your income is concerned, maybe you should consider getting back into the kind of business you ran previously for a while. Look for a managerial or supervisory position in that area, at least until you’re able to get back on your feet and save some cash.

Finally, cut up the credit cards, close the accounts, and put as much money as you can spare toward paying off that debt using the debt snowball system. Never go back into debt again!

—Dave

Pay off the house first?

Dear Dave,

My husband and I are in our forties. We have no children, and we bring home $95,000 a year combined. We’re also debt-free except for our home. We owe just $10,000 on the house, and can take care of that in a few months. Would it be okay to rearrange the Baby Steps a bit, and pay off our home before getting serious about saving for retirement?

Nan

Dear Nan,

I don’t usually give folks any wiggle room when it comes to sticking with the proper order of the Baby Steps. But if you’re that close to being completely debt-free, I don’t see anything wrong with paying off the house first.

Most people I talk to still have anywhere from $100,000 to $300,000 left on their mortgages. This is a little bit different story, however, and you two are obviously managing your money well.

Knock out that mortgage, and start pouring at least 15 percent of your income into retirement. You’re going to love the feeling — and the freedom — that comes with being completely debt-free!

—Dave

Better late than never

Dear Dave,

I have a credit card that I haven’t made a payment on in almost two years. The debt has been sold a couple of times, and now a collector is saying I owe $1,200. The original amount was $500. I’d like to work something out, but I can’t afford $1,200. What should I do?

Luanne

Dear Luanne,

They’re asking for $1,200 because they’ve added things like interest and late fees. They want to make as much money as possible on an old debt they bought for pennies on the dollar.

If you can afford $500 right now, ask if they’ll accept a one-time payment to settle the account. Get it in writing if they accept the offer, and don’t give them a penny until after you get a copy of the written agreement. Once you have the agreement in hand, send them a money order or cashier’s check for $500. Do not, under any circumstances, give them electronic access to your bank accounts.

You waited too long to take care of your obligation, Luanne. That made things more difficult and more stressful than necessary. I’m glad you decided to do the right thing, and clean up your mess, though. Better late than never!

—Dave

Keep it in your own pocket

Dear Dave,

I just filed taxes, and it looks like I’ll get a pretty big refund this year. A friend of mine told me I should adjust my withholding, so I don’t get a refund. This seems pretty dumb to me. Why would I change my withholdings when I’m getting money back?

James

Dear James,

The only reason you’re getting a refund is because you had too much taken out of your paychecks in 2017.

Let’s say your refund is $3,500. Basically, you loaned the government $3,500 of your own money, interest-free. A refund isn’t a gift or reward, James. It’s your own cash that you get back because you paid in too much during the previous year. In your case, that adds up to almost $300 a month!

Instead of loaning the government money that you worked hard to earn, wouldn’t it be a better idea to keep it in your own pocket?

—Dave

Not as bad, but still not smart

Dear Dave,

How do you feel about check cashing companies?

Norman

Dear Norman,

I’m not a big fan of check cashing companies. They’re not nearly as bad as payday lenders, but it still seems kind of silly to me there’s even a market for this kind of thing. If you want a place to cash your checks and store your money, all you have to do is walk into a bank and open an account.

I realize there’s a small segment of the population that some people in financial circles like to call “the unbanked.” This means that, for whatever reason, they avoid banks. That’s their choice, but in the process, they leave themselves susceptible to bad deals.

As I said, I don’t feel the same way about check-cashing companies as I do about payday lenders. But it’s still not a financially smart move to regularly pay a storefront operation fees just to cash your checks.

—Dave

Here’s a better idea

Dear Dave,

I’m 27 years old, and I have no debt. In addition, I have a five-month emergency fund of $14,000. Recently, I started a new job making $60,000. I’ve been offered a 401(k) with no match, but I was wondering if instead I should open a high-yield CD.

Kris

Dear Kris,

You’re doing very well at a young age. Congratulations! I’m glad you’re thinking about your financial future, too. But I’ve got a better idea.

How about opening a Roth IRA with good growth stock mutual funds inside? That would be my choice. Fund it up to $5,500 a year, and make sure the mutual funds have strong track records of at least 10 years. This investment — growing tax-free — will be superior to a non-matching 401(k) or certificate of deposit. If you want to invest even more, you could then put additional cash into the 401(k) offered by your company.

With your income and maturity, plus the proper investment strategy, you’re likely to retire a very wealthy lady. Keep up the great work, Kris!

—Dave

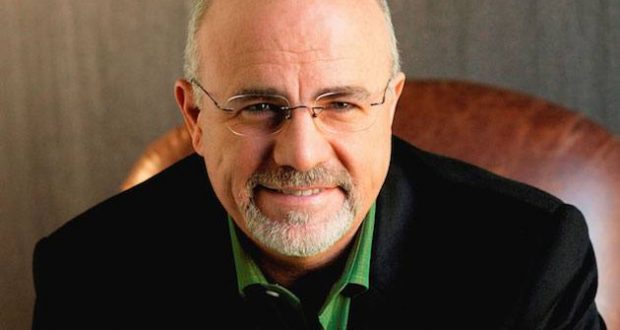

- Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Showis heard by more than 13 million listeners each week on 585 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.

How Do Real People Overcome Challenges?

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community