Ryan Shumaker, Smartvestor Pro at The Retirement Team

Last month we discussed the SECURE Act and its projected $15.7 billion tax increase on beneficiaries of tax deferred retirement accounts (like 401(k)s, 403(bs), TSPs, IRAs, etc.). The only ones excluded from this new way of distributing retirement accounts are spouses, beneficiaries that are less than 10 year younger than you, and individuals with a disability or chronic illness.

These beneficiaries can elect to take a small required amount each year over their lifetimes rather than empty the entire account within 10 years like the new rules specify. Also, the start on the 10 year distribution clock is delayed for minor children of the owner until they reach 18 (so if they are 12 now they would have 16 years to take everything out of a retirement account since their 10 year clock doesn’t start until 18).

READ: The new $15.7 billion tax on retirement accounts

As we outlined in the last article, beneficiaries being forced to take out large retirement account balances over 10 years will likely lead to much higher taxes being paid since larger withdrawals each year can push them into a higher tax bracket.

One way to avoid this is to convert what you have in tax deferred retirement accounts (like 401(k)s, 403(bs), TSPs, IRAs, etc.) over to a Roth ahead of time. You can convert an unlimited amount that is in an IRA over to a Roth each year if you pay the taxes due. Once in a Roth there will never be taxes again. So, if a beneficiary inherits a Roth they can just leave the money in the Roth growing tax free for 10 years and then at the end of 10 years take out everything that is in there, included all of the gains, completely tax free.

With there currently being temporary tax cuts, it makes sense for many individuals to start converting over to a Roth. The passage of the SECURE Act is just making it even more important.

Sometimes waiting to pay taxes on a retirement account is like waiting to call the plumber for a leaking pipe; it’s usually not going to be cheaper later. Does this mean you should take everything you have and convert it to a Roth all at once? Probably not. You need to have a tax map ran to see how much makes sense to convert to a Roth each year by a professional that knows and understands the tax code.

Unfortunately it isn’t as easy as just looking at the tax bracket tables and coming up with a number. There are many hidden spikes in taxes along the way, especially for those in retirement.

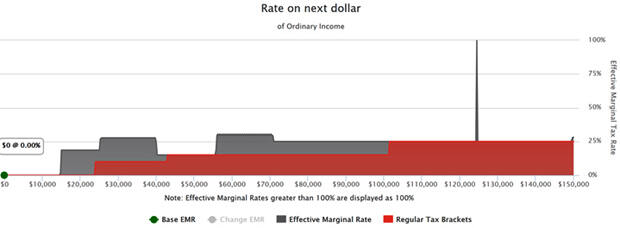

Below is an example of one couple we recently helped do some tax planning. In red are the tax brackets as income increases and in grey is the true tax they would pay on a retirement account withdrawal whether it be for income or converting to a Roth. You can see as income increases from withdrawals or conversions as you go left to right how the tax is actually lower on income from $40,000 – $55,000 than what it is from $25,000 – $40,000.

The tax code is odd and confusing at timesJust because you have a lower income, doesn’t mean you will pay a lower tax. Everyone’s tax map will look different from the one pictured, which is why it is so important to have one ran for your exact situation to find where the opportunities to pay less in tax lie.

So what if you can’t efficiently or effectively convert money over to a Roth at a reasonable tax rate? A solution in that case may be to purchase guaranteed life insurance. This is a common tool that high net worth individuals use when it comes to estate transfer. Essentially the life insurance is used to pay the tax so that the other assets remain intact whether they are retirement accounts, a business, farm, etc.

This is a more advanced type of planning technique that in the past made the most amount of sense for high net worth households, but now with the SECURE Act may make sense for a larger number of individuals.

Material discussed is meant for general/informational purposes and is not intended to be used as the sole basis for any financial decisions, nor be construed as advice to meet your particular needs. Please consult a financial professional for further information.

Investment advisory services offered through Next Generation Investing, LLC.

Securities offered through World Equity Group, Inc. member FINRA and SIPC.

Next Generation Investing, LLC, & The Retirement Team are not owned or controlled by World Equity Group.

Insurance and annuities offered through Ryan Shumaker, KS Insurance License #10359614.

Ryan can be contacted at 785-228-0222 or RetireTopeka.com.