The fall in consumer spending has local officials puzzled; there’s a reason why Kansans are buying fewer things at the register. Not surprisingly, counties with declines in consumer shopping also have hiked property taxes. Couple that with the state income tax increase, and the collective tax burden on Kansas families (especially low-income) has increased by billions of dollars.

Over the year, 91 county governments increased property taxes. The vast majority of counties are also dealing with shrinking sales tax revenue. Moreover, since the sales tax increase in 2016, the total property taxes on Kansans have risen 9% or more than $420 million.

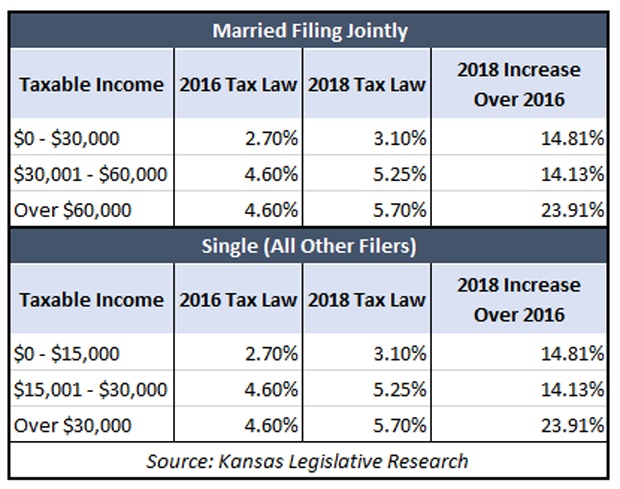

Kansas state government plays a role here as well. In May 2017, the state government passed the most massive tax increase in state history. Additionally, it was retroactive and expected to take $600 million out of the Kansas economy. As of the fiscal year 2019, state income tax collections were near $3.8 billion. In 2016, state income tax levels were at $2.25 billion. Taking the difference, record income tax increases have taken $1.6 billion from the private sector. The adjacent table highlights changes in tax rates. The largest tax hike was on those making above $60,000 married and $30,000 single. The 2nd largest tax increase was not on the middle-income bracket, but on the lowest. If you are married and work full time at minimum wage, then you had a higher tax increase than a married couple making between $12 and $15 an hour full time.

The tax increase removed a provision that exempted low-income Kansans from income tax rates. Consider a married family with two children and two minimum wage jobs (earning roughly $30,000). In 2016, this family wouldn’t owe state income taxes. That exclusion is now a fraction of what it once was. Today, the same Kansas family would owe almost 400 dollars in state income taxes. Roughly 15% of all Kansas families fell into the tax increase trap. That means state tax policy increased taxes on low wage earners to the tune of at least $40 million. Let’s not forget that income tax rates rose at least 14% on everyone else. It’s not a surprise that raising taxes depresses shopping.

In two years, Kansans’ property taxes rose 9%, their state income taxes grew at least 14%, but their income only grew by 6%. The budget practices of state government are one reason why Kansas has the 8th highest sales tax rate in the country. As for local leaders, too many have avoided lowering mill levies to rising property valuations to keep taxes level for Kansas residents. Like the state budget reaching record levels, perhaps local government is more focused on growing spending. Elected leaders should recognize the heavy toll placed on Kansans. Their government budgets reflect that toll.

Supreme Court says “Right to life” means right to abortion