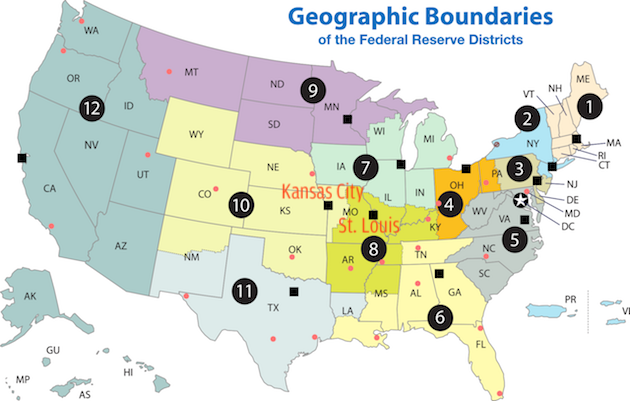

In 1913, a US Senator from the Kansas City, Missouri area flipped his vote, and the Federal Reserve System was created.

Senator James A. Reed gave us central banking with 12 autonomous banks across the country due to his vote, Missouri (the 7th most populous state at the time) won two Federal Reserve Banks, one in St. Louis (I) and one in Kansas City (J).

A tour of the Kansas City Fed is a great way to learn, and you can actually walk out with money, but some assembly is required. Every dollar bill issued has a reference to the Federal Reserve Bank that issued it, as the serial number starts with the letter of the bank.

The Kansas City Federal Reserve District is unique in that all but two of the banks in the district are community banks. There are branch banks of Bank of America, Wells Fargo, Citibank, larger banks from other districts, but the banks headquartered in the Kansas City District are smaller banks, and it is these banks that are bearing the most scrutiny after the Silicon Valley Bank failure, because on their size.

Locally, we have actually witnessed a bank failure

Locally, we have actually witnessed a bank failure and how it could be smoothly handled with the failure of BC Bank. The FDIC insured each account registration up to $250,000, but in most cases, the insurance comes into play with the sale of the bank assets to another bank. In terms of BC Bank, the acquiring bank was Community Bank of Pleasant Hill, Mo. It was handled smoothly.

The differences between BC Bank and Silicon Vally Bank are size and assets. The FDIC put the assets of SVB out for bid, but received no bids. No other banks wanted to acquire the assets, so technically the FDIC is on the hook for all of the losses to account holders up to $250,000 per account registration.

The problem was that the bank had accounts with millions and even billions in them. Usually in the bank sale of assets, the assets shift and little, if any, Federal Insurance funds are required.

So, how does a bank fail? A bank can fail when the reserves of the bank are no longer sufficient to cover the requirements of the loan portfolio, or if their income cannot cover their expenses, cash flow. When banks are put together they sell shares of stock, but usually collect twice the share price, half being equity and the other half being reserves.

From the reserves, banks make loans, new money based on the reserves. If the reserve ratio is 10%, for every $1000 in reserves, the bank can issue $10,000 in loans, but with checks being written the bank has to maintain the ratio, and most banks know how many dollars lent will stay with the bank, and how many dollars will flow in or out, from other banks.

Cash reserves, something primarily called M1, is the cash in the vault and the cash on hand in the bank’s account at the Federal Reserve or at a correspondent account at another bank. Smaller banks have correspondent bank accounts.

In theory, banks can hold customer funds in savings accounts for as much as 30 days before releasing funds, but few banks do it.

Banks are supposed to have considerable regulation, both in terms of state regulations, Federal Reserve regulation, and Federal Deposit Insurance regulation. In theory, banks can hold customer funds in savings accounts for as much as 30 days before releasing funds, but few banks do it.

Regulation CC determines how fast a bank can take to recognize large deposits, but in some cases this, too, is waved for handling payroll and other matters. Most banks set their own rules, but, in terms of large deposits they may require 8 business days before making the entire deposit available. You are supposed to be notified at the time of the deposit.

The first line of regulation is the state bank examiners. Smaller banks, with fewer services, maintain a correspondent relationship to handle some services, such as wires, and these banks have their own requirements. The second regulation is the Federal Reserve Bank which sends out auditors.

Many years ago, in a discussion with one of the Federal Reserve auditors, their auditors were standing in line to audit a bank in Kansas, where the bank had foreclosed on a brothel in the town square, selling it to its own holding company because banks were not allowed to own illegal businesses. It happens, and the stories would make great press if the public knew. Usually bank examiners know what they are going to see before they see it.

The problem comes when the bank, to maintain reserves, has to sell Treasuries that have not matured. US Treasuries in the market tend to fall in value as interest rates climb, and if a bank has to sell them, the market will not pay full price. In terms of Silicon Valley Bank, the Federal Reserve offered to buy all of the US Treasuries held by the bank at face value to help manage losses to the FDIC.

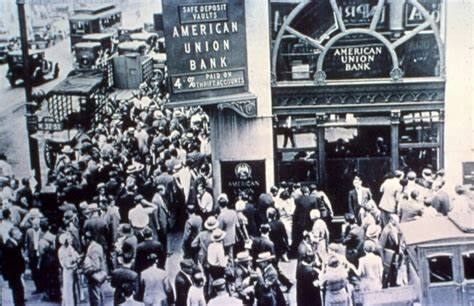

In today’s terms, the concept of a bank run, standing at the window of the Bailey Building and Loan and demanding cash is a thing of the past. Today, you can write a check, use your debit card, use an ACH (electronic check), or even a wire to move assets in and out of a bank. The danger is that when assets move, they reduce the reserve requirement by a fraction while reducing reserves by 100% of the value of the check, draft, or other conveyance.

Local banks know their customers. They know how many dollars are moving in and out of the bank, and they do a good job of maintaining all their assets. The bank failures we are seeing are more a result of state bank examiners in other states failing to do their jobs.

Knowing your banker and your banker knowing you is the best defense against a bank run.

–Bob White is a Kansas City-area resident and history writer for Metro Voice. Search his name on our homepage search bar for more or read his other stories HERE.