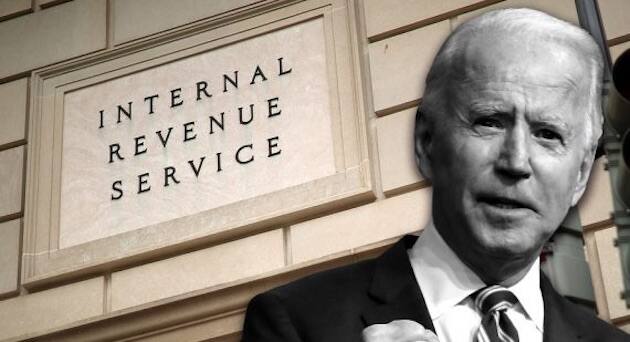

If the Democrat-controlled Congress enacts invasive new bank financial reporting rules, Missouri Treasurer Scott Fitzpatrick will not comply. The proposal being pushed by the Biden administration requires financial institutions to report information on personal and business accounts to the IRS if they exceed just $600 in incoming or outgoing cash.

“Turning over their transaction data to the federal government is illegal under Missouri law and a gross violation of Missourians’ expectation of privacy when it comes to their personal financial records,” he said. “I will not turn this information over to the IRS voluntarily and will fight in court to block any attempt by the federal government to compel my office to comply with this mandate. This proposal is nonsensical and unnecessary and should be rejected by every member of Congress.”

READ: Congress wants to look inside your bank account

Fitzpatrick, a Republican candidate for state auditor and vice-chair of the State Financial Officers Foundation, joined almost two dozen other state financial officers on a letter to President Joe Biden and Treasury Secretary Janet Yellen opposing the idea last month, pointing to concerns over privacy and the risk of cybersecurity breaches.

The measure, if Congress approves it to fund Biden’s sweeping $3.5 trillion spending and climate change plan, would give the IRS an enormous amount of new information that it would have to learn how to manage and use.

Banks banks say the plan would increase compliance costs and add to the already existing burden the industry faces in turning over information to the government.

Patrick Hedger, vice president of policy at the Taxpayers’ Protection Alliance, warned that such a proposal could violate the Fourth Amendment, which protects citizens from search and seizure without probably cause.

‘The IRS is first and foremost, a law enforcement agency, and the Fourth Amendment protects against unreasonable searches and seizures in pursuit of, of looking for wrongdoing and criminal actions, so I think this is going to run into severe Fourth Amendment headwinds,’ Hedger told DailyMail.com.

Another provision that has drawn the ire of Missouri officials and agriculture groups is the elimination of the stepped-up basis rule that sees the government adjust appreciated values of a house or stock portfolio when passed down to the next generation as an inheritance. The rule protects heirs of properties under an $11.7 million threshold from paying what is known in agricultural circles as the “death tax” — a tax on the transfer of property after someone’s death.

The bill is making its way through Congress.

–Alan Goforth and Dwight Widaman | Metro Voice