Need some financial advice? Debt and Income Crisis? Pay off the house first? Check cashing? Taxes? Check out what folks are asking Dave Ramsey.

Postpone the Marriage?

Dear Dave,

My fiancé and I are planning to be married in less than a year. We’ve both been through your class at church, and the other night we started wondering if we should wait to have the wedding until we’re both completely debt-free. Would you give us your opinion?

Michelle

Dear Michelle,

Congratulations! I hope you two will have long and happy lives together.

To answer your question, I don’t think there’s a reason to wait. When two people know they really love each other, they should get married whenever they feel in their hearts the time is right.

At this point, you shouldn’t be thinking about money as anything except an indicator of where you’re going. It doesn’t matter who got into debt or how, because everyone makes mistakes. But if you’re both serious about getting out of debt, living on less than you make, and are in agreement about how the dollars are going to be handled, then — where money is concerned — you’re ready to be married.

Many relationship experts say if a couple can agree on four important things — kids, money, religion, and how to handle the in-laws — they have a great statistical chance of a happy marriage. I believe this, too. And make sure you meet with your pastor for some good, pre-marital counseling before the big day. With all this going for you, I think you two will be okay.

God bless you both!

—Dave

Here’s a better idea

Dear Dave,

I’m 27 years old, and I have no debt. In addition, I have a five-month emergency fund of $14,000. Recently, I started a new job making $60,000. I’ve been offered a 401(k) with no match, but I was wondering if instead I should open a high-yield CD.

Kris

Dear Kris,

You’re doing very well at a young age. Congratulations! I’m glad you’re thinking about your financial future, too. But I’ve got a better idea.

How about opening a Roth IRA with good growth stock mutual funds inside? That would be my choice. Fund it up to $5,500 a year, and make sure the mutual funds have strong track records of at least 10 years. This investment — growing tax-free — will be superior to a non-matching 401(k) or certificate of deposit. If you want to invest even more, you could then put additional cash into the 401(k) offered by your company.

With your income and maturity, plus the proper investment strategy, you’re likely to retire a very wealthy lady. Keep up the great work, Kris!

—Dave

Save up, or get a mortgage?

Dear Dave,

I’m 28, single, and I just became debt-free. In addition, I make $70,000 a year and have the equivalent of six months of expenses set aside for emergencies. Should I save up to pay cash for a house, or is mortgage debt okay? I’d like to keep the price of a new home between $200,000 and $225,000. Since I currently live in a nice apartment, I think I can save about $20,000/year. What do you think?

Kathryn

Dear Kathryn,

It sounds like you’re in great financial shape. Congratulations on becoming debt-free!

Let’s take a look at both scenarios. If you can save $20,000 a year, that means you’re about 10 years away from a nice, paid-for home, and you’re still debt-free. That’s one option. At the same time, I don’t yell at people for taking out a 15-year, fixed-rate mortgage, where the payments are no more than 25 percent of their monthly take home pay. In this situation, you could save like crazy for a couple of years and make a big down payment on a home in the price range you’re talking about. Then, you could pay off that house in just 15 years.

—Dave

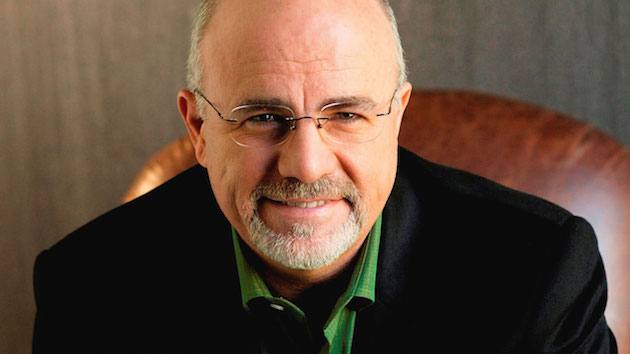

- Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Showis heard by more than 13 million listeners each week on 585 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.

Dave Says: Debt and Income Crisis