403(b)

-

Getting The Taxman Out Of Your Retirement — Part 2

Last month, in part one of this article, we discussed how you might be in a lower tax bracket in…

Read More » -

The Retirement Team voted ‘Best of Topeka’ for 2021

It’s been a season full of recognition for The Retirement Team, a financial advisory firm based out of Topeka. The…

Read More » -

Stop losing retirement money safely

Over the course of the average retirement all prices more than double. In fact, they’ll go up more than 2.5…

Read More » -

Columns

How to get cheap (or free) health insurance if you retire early

I often hear when I first meet with someone that the only reason they are still working is to pay…

Read More » -

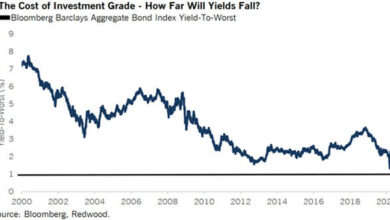

How low can rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index…

Read More » -

‘401(k) plan owners: Watch out’

Imagine how you would feel if you were on a sinking cruise ship and couldn’t get off because there weren’t…

Read More » -

One reason why ‘target dated’ funds haven’t done well for over a decade

There’s a reason why we often refer to target date funds as ‘target dated’ funds. These types of investments rely…

Read More » -

Finances

Nearly 1/3 of investors 65+ sold at the stock market bottom

Typically when you fail to plan, you are planning to fail, and that applies to the stock market. It’s best…

Read More » -

Finances

Don’t play politics with your portfolio

Did the outcome of the election make you really happy and excited? Or did it leave you concerned, especially when…

Read More » -

Finances

How low can interest rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index…

Read More »