Ryan Shumaker, Smartvestor Pro at The Retirement Team

Over the course of the average retirement all prices more than double. In fact, they’ll go up more than 2.5 times. Something that costs $100 today will cost $257 by the end of a 30 year retirement. That’s assuming just historical average levels of inflation as measured by the US Bureau of Labor Statistics. Lately things have been anything but average with inflation hitting record highs!

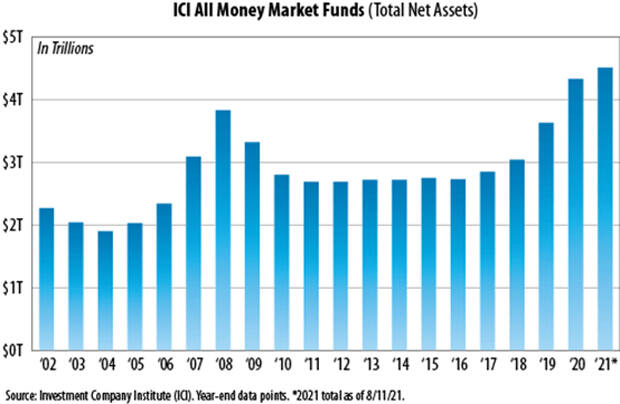

While interest rates have come up a little since their all time record lows of last year, rates for many conservative investments are still substantially lower than current inflation levels. According to BankRate.com, the average money market account is paying a paltry 0.07% interest, the average 1 year CD 0.17%, and the average 5 year CD 0.31%. The wild thing is that in no point in history has there ever been at the end of any year more money in money market than what there is today. The sad part is that all of this money is earning about the least it ever has too.

If you had $100 last year and earned just 0.07% interest on it you now have $100.07. The problem is that something that cost $100 last year now costs $105.40 (or even more). In essence sitting in a money market earning this amount cost you $5.33 in buying power. You have safely and slowly lost over the last 52 weeks to inflation. Given that the M2 measure of the money supply is now a stunning 33% higher than what is was pre Covid (meaning there are literally 33% more US dollars that exist today than what did in February of 2020), one can probably assume inflation is not going to go back to where it was prior to the pandemic anytime soon.

Besides taxes in retirement, the biggest problem we help most people solve is ensuring they have an ever increasing income to offset ever increasing prices. When conservative investments across the board (whether they be bonds, CDs, money market, guaranteed annuities, etc.) are generally earning the least they ever have it is quite difficult to accomplish this goal by having most or all of your money in these types of instruments. Annuities that guarantee income streams are paying out record low levels as most all of them are backed by bonds paying historically low interest. Plus, any guaranteed income stream whether it be from an annuity, pension, etc. that does not increase over time is just assuring that each and every year your actual spendable income (what you can buy with that income stream) will continuously decrease. Again, with just average inflation over the average retirement something that costs $100 today will cost $257 at the end. If you have an income stream that stays the same over your retirement you’ll only be able to buy 39% of what you could have at the beginning.

Imagine if your budget got slashed by over 60%. How would that impact your lifestyle? That’s what you need to plan on happening if your income stays the same throughout your retirement. Having the same income means safely and slowly having a massive reduction in lifestyle over time.

The approach we’re using with our clients aright now is to try and have as little in investments that are earning less than inflation while ensuring there is still enough to never have to ‘sell low’ or lock in losses to generate income. If you’re relying on traditional growth mutual funds or index funds you could go over a decade (the S&P 500, for instance, was at the same value in 2011 as it was in 2000) with no gains, which means you might need more than 10 years worth of income sitting in conservative investments that are safely and slowly losing money to inflation in order to make sure you have enough to never have to sell low. Having that much earning so little will likely lead to poor results. Our flagship investment strategy is being managed to make up any losses in only 3 years. If you only need 3 years worth of income in conservative investments this reduces the amount that is slowly losing and increases the amount that is growing, which will help with having ever increasing income to offset ever increasing prices. The bonus part of this is that even though it is a moderate risk strategy it has outperformed the majority of aggressive investments over time.

If having ever increasing income in retirement is important to you, give our team a call today at 785-228-0222 to schedule a complementary consultation.

Other great articles about retirement, investing, and tax reduction can be seen at RetireTopeka.com/blog.

READ: How to get cheap (or free) health insurance if you retire early

Material discussed is meant for general/informational purposes and is not intended to be used as the sole basis for any financial decisions, nor be construed as advice to meet your particular needs. Please consult a financial professional for further information. Investing in securities involves risk and profit cannot be guaranteed.

Investment advisory services offered through Next Generation Investing, LLC.

Securities offered through World Equity Group, Inc. member FINRA and SIPC.

Next Generation Investing, LLC, & The Retirement Team are not owned or controlled by World Equity Group.

Insurance and annuities offered through Ryan Shumaker, KS Insurance License #10359614.

Ryan can be contacted at 785-228-0222 or RetireTopeka.com.

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community