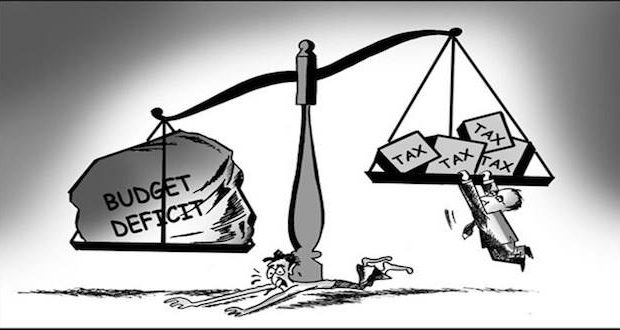

Missouri’s Department of Revenue is in a pickle after it shocked state lawmakers Wednesday by announcing a $532 million dollar budget deficit.

The news has state lawmakers wondering what happened, who’s to blame and how it can be fixed without increased taxes.

The agency’s monthly report for December, which came out January 4 pegged the shortfall at just $130 million, and state Budget Director Dan Haug indicated the deficit was much the same January 16 during a briefing before Governor Parson’s State of the State address. That means an additional $400 million hole has materialized in roughly a week.

The recently appointed chair of the Senate committee that handles the budget, Republican Dan Hegeman of Cosby, doesn’t think the Revenue Department has shown itself to be incompetent. “I think most of us understand that they could have communicated better,” said Hegeman. “I think when they noticed the error and corrected the error and tried to get it out there, I think they did that as effectively and efficiently as they possibly could.”

Newly elected Republican Senate Majority Floor Leader Caleb Rowden of Columbia thinks the revenue agency must be held responsible for any shortcomings in its performance. “If there were issues in how it was handled, the process in which we got to the place that we are now, somebody needs to be held accountable for that,” said Rowden.

The budget shortfall has been linked to an under collection of state income taxes after the federal tax overhaul passed by Congres took hold last January. The Revenue Department announced in September that it incorrectly analyzed how state collections would be affected by federal changes. Missouri bases its tax structure on the federal system. Congress doubled the standard deduction and eliminated the personal exemption.

The Revenue Department also admitted in September that the unexpected decrease in withholding was due to a longstanding inaccurate calculation of the federal tax deduction that had gone undetected until last year’s federal changes amplified the error.

As a result of the mistakes, the Department announced it had reworked the tax tables in September to collect more from individual paychecks. But making the adjustment so late in the year means taxpayers will have to make up for the under collection on the yearly returns they file. The ballooning deficit has increased fears that filers will be acutely impacted. Those who typically receive a big refund could see it massively shrink or could find themselves in debt to the government while others might owe large sums of money.

Republicans and Democrats disagree on how to assist low-income filers who may be hit with unexpected liability on their returns.

Democrat House Minority Leader Crystal Quade of Springfield and Senate Democrat John Rizzo of Kansas City have identical bills to provide relief to taxpayers who owe less than $200. The deadline for those filers to submit their returns would be extended from April 15th to June 15th. The bills would also provide for a four-month interest-free plan for those who have difficulty paying the bill. Those filers would have a deadline of October 15th.

Senator Rowden says the legislation isn’t necessary because the Department of Revenue already offers payment plans for more than 10,000 filers who need the assistance. Walsh doesn’t think the state can be trusted to provide relief for taxpayers, noting she saw major mistakes made by the Revenue Department as a former member of the budget committee.

With the personal exemption now done away with, Missouri taxpayers will want to rethink their filing strategy. Those claiming the most dependents will now owe the least amount of money on their returns while filers who claim “0” will have a liability.

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community