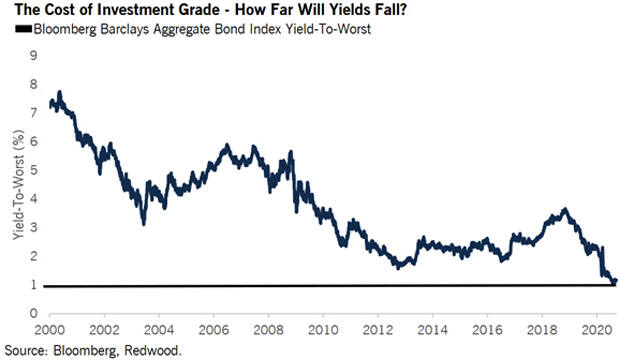

How low can rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for investors to get the same amount of interest from their bonds or bond funds they need a staggering 7 times as much money.

Bonds have been a great place to make decent money with lower levels of risk, especially 10-20 years ago. Why? Because not only were bonds paying a much higher interest rate then, but bonds also gain in value when interest rates fall. Things are much different today. Interest rates are at their lowest level in history, without much more room to go lower. If interest rates merely stay where they are, then investors are going to get an interest rate that is only 1/3 of what historical inflation has been. This means that every single day a person would be losing buying power with their money since their investment would be growing 3 times slower than what prices (inflation) are rising.

Things get much worse when interest rates rise. When that happens bonds lose value. Let me give an example. Let’s say you go and buy a bond from a school that cost $100 and is paying 1%. Now let’s say interest rates go up to 2%. If someone can go buy a new bond from the school that is paying 2% for $100 no one is going to want to give you $100 for the one paying 1% that you own. You’re going to have to take less. This is why when interest rates rise, bonds lose value.

The big question is ‘how much do they lose?’ To find that out with any bond index of bond fund you must look at something called ‘average effective duration.’ This is a measurement of how much the bonds will gain or lose when interest rates go up or down. Right now for the Aggregate Bond Index that number is about 6.5. What this means is that if interest rates rise just 1%, then the bonds will lose 6.5%. If interest rates go up 2%, then the bonds would lose a whopping 13%. Given that the bonds are only paying 1% in interest right now we believe this is a pretty big risk to be taking for such a little amount of investment return.

We are concerned that with interest rates plummeting the last two years (which you can see in the chart) and bond funds gaining value because of this that too many people are being lured into a false sense of security with inappropriate expectations for how most bond index funds should perform. The unfortunate thing is that with this index the ‘average effective duration’ was actually SMALLER when interest rates have been going down the last 2 years than what it is now. This means that if interest rates merely go back to where they were in 2019 that investors will lose more as rates go back up than what they gained when rates went down.

READ: ‘401(k) plan owners: Watch out’

3 things can happen with interest rates right now. They can go down more, but there’s not too much further they can fall when they’re already at 1%. They could stay the same, which would mean those invested in them would earn 3 times less than inflation, or they could go up causing losses that are likely more than what the interest the bonds are paying.

If you own any bond funds, we believe it is very important to know what risks are being taken. The largest bond fund in the world right now follows the exact index we’re talking about in this article. If you have a mutual fund or ETF with ‘total bond market’ or ‘aggregate bond market’ in its name, it likely follows this popular bond market index. Many ‘target date retirement funds’ have a bond fund like this as their single largest holding. While that may have worked very well 20 years ago, it is mathematically impossible for that to continue to work as well today. We have never been in an interest rate or investing environment like we are in today. It is much more difficult to get a good return on conservative investments. In our opinion, it is important to seek out ones that instead of losing when interest rates go up will actually gain and pay higher interest when that happens. There are numerous investments out there that have this feature, but unfortunately many don’t know where to look or don’t have the expertise to select them.

As part of our firm’s complimentary 3 step review, we help people find ways to get reliable income that isn’t going to be hit when interest rates inevitably rise. We also find as much money as we can that is needless falling through the cracks to things like taxes. Every dollar saved on taxes is 1 less dollar of interest needed to get the same amount of income in retirement. Now more than ever it is important to get all of the other little things correct when it comes to retirement as the margin for error is so much smaller. With interest rates being more than 7 times less for people retiring today than what their parents would’ve experienced 20 years ago what worked well for them is unlikely to work well for someone retiring today.

–Ryan Shumaker, Smartvester Pro at The Retirement Team. Material discussed is meant for general/informational purposes and is not intended to be used as the sole basis for any financial decisions, nor be construed as advice to meet your particular needs. Please consult a financial professional for further information. Investing in securities involves risk and profit cannot be guaranteed. Investment advisory services offered through Next Generation Investing, LLC.Securities offered through World Equity Group, Inc. member FINRA and SIPC.

Next Generation Investing, LLC, & The Retirement Team are not owned or controlled by World Equity Group. Insurance and annuities offered through Ryan Shumaker, KS Insurance License #10359614. Ryan can be contacted at 785-228-0222 or RetireTopeka.com.