Last month, in part one of this article, we discussed how you might be in a lower tax bracket in retirement, but pay a higher tax rate. In this article, we’ll look ...

Read More »The Retirement Team voted ‘Best of Topeka’ for 2021

It’s been a season full of recognition for The Retirement Team, a financial advisory firm based out of Topeka. The business recently swept The Best of Topeka finance categories, earning Best Financial ...

Read More »Stop losing retirement money safely

Over the course of the average retirement all prices more than double. In fact, they’ll go up more than 2.5 times. Something that costs $100 today will cost $257 by the end ...

Read More »How to get cheap (or free) health insurance if you retire early

I often hear when I first meet with someone that the only reason they are still working is to pay for health insurance until they can get on Medicare at age 65. ...

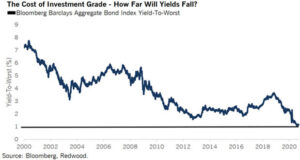

Read More »How low can rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for ...

Read More »‘401(k) plan owners: Watch out’

Imagine how you would feel if you were on a sinking cruise ship and couldn’t get off because there weren’t any life jackets or backup boats. Now ask yourself, if you were ...

Read More »One reason why ‘target dated’ funds haven’t done well for over a decade

There’s a reason why we often refer to target date funds as ‘target dated’ funds. These types of investments rely on portfolio construction techniques to decide what to own based on decades ...

Read More »Nearly 1/3 of investors 65+ sold at the stock market bottom

Typically when you fail to plan, you are planning to fail, and that applies to the stock market. It’s best to have a plan before trouble comes, rather than make emotional decisions ...

Read More »Don’t play politics with your portfolio

Did the outcome of the election make you really happy and excited? Or did it leave you concerned, especially when it comes to your investments? Either way, you shouldn’t play politics with ...

Read More »How low can interest rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for ...

Read More »Should you change investments ahead of the election? Maybe.

Worried about what might happen to financial markets and your investments if we have the first contested election in 20 years, or if your candidate doesn’t win? You aren’t alone. Unfavorability ratings ...

Read More »Who’s gonna pay for the ‘free’ lunch

The saying “there’s no such thing as a free lunch” has been attributed to many people over the years. Someone must produce and someone must pay for what we consume. There has ...

Read More »Nearly 1/3 of investors 65+ sold stocks at the market bottom

Typically when you fail to plan, you are planning to fail. It’s best to have a plan before trouble comes, rather than make emotional decisions on the fly during times of duress ...

Read More »The trouble with trillions

Recently, President Trump signed ‘phase 3.5’ of emergency interim coronavirus relief, which comes with nearly a half trillion dollar cost. All told the current running total is in the trillions, exceeding $4 ...

Read More »Ways to avoid the new tax increase on retirement accounts

Last month we discussed the SECURE Act and its projected $15.7 billion tax increase on beneficiaries of tax deferred retirement accounts (like 401(k)s, 403(bs), TSPs, IRAs, etc.). The only ones excluded from ...

Read More »The 401(k) / IRA IQ Quiz: How safe is your retirement?

While we all love the season of giving, there is one place that many are likely giving far more than they should: the Internal Revenue Service. As we’ve pointed out in our ...

Read More »The ‘7% guaranteed’ annuity myth

One of the most common things I see when someone comes into our office for the first time if they own or have been pitched an annuity is the belief that the ...

Read More »Beneficiary mistakes can cost a fortune

Beneficiary designations are important in determining where certain assets of an estate will end up. Many think that a will or trust is what determines where everything goes. This is not necessarily ...

Read More » Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community