JPMorgan CEO Jamie Dimon is issuing a stark warning, stating many U.S. businesses and investors are unprepared for the possibility of the Federal Reserve raising interest rates to a staggering 7 percent. ...

Read More »Christians take out payday loans despite excessive interest rates

More than one-third of Christians in states that don’t regulate payday loans say they have obtained them, despite believing that charging excessive interest is a sin. In a recent survey, Lifeway Research ...

Read More »Home mortgage rates rise above 7%

Mortgage rates have hit a two-decade high rising above 7 percent. The milestone comes as the U.S. housing market continues to tank with more buyers choosing to wait out the recession and ...

Read More »Mortgage interest rates surge past 6% with no signs of stopping

The average interest rate on the most popular U.S. home loan rose above 6 percent for the first time since 2008 and is now more than double the level it was one year ago, ...

Read More »Canadians warned of huge housing market correction

Canadians could see housing prices drop by as much as 18% by the end of 2023, according to a new real estate outlook report. The report comes as, like recent U.S. Federal ...

Read More »What every homeowner should know about a recession

A recession does not equal a housing crisis. That’s the one thing that every homeowner today needs to know. Everywhere you look, experts are warning we could be heading toward a recession, ...

Read More »Getting The Taxman Out Of Your Retirement — Part 2

Last month, in part one of this article, we discussed how you might be in a lower tax bracket in retirement, but pay a higher tax rate. In this article, we’ll look ...

Read More »The Retirement Team voted ‘Best of Topeka’ for 2021

It’s been a season full of recognition for The Retirement Team, a financial advisory firm based out of Topeka. The business recently swept The Best of Topeka finance categories, earning Best Financial ...

Read More »Stop losing retirement money safely

Over the course of the average retirement all prices more than double. In fact, they’ll go up more than 2.5 times. Something that costs $100 today will cost $257 by the end ...

Read More »How to get cheap (or free) health insurance if you retire early

I often hear when I first meet with someone that the only reason they are still working is to pay for health insurance until they can get on Medicare at age 65. ...

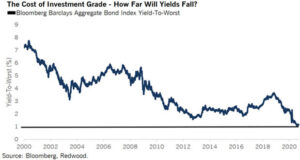

Read More »How low can rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for ...

Read More »Dollar Tree not exactly a dollar in response to inflation crisis

Dollar Tree is the latest retailer to change its business practices in response to what’s becoming known as the “Biden Inflation Crisis”. The popular store, which until now only sold $1 items, ...

Read More »‘401(k) plan owners: Watch out’

Imagine how you would feel if you were on a sinking cruise ship and couldn’t get off because there weren’t any life jackets or backup boats. Now ask yourself, if you were ...

Read More »One reason why ‘target dated’ funds haven’t done well for over a decade

There’s a reason why we often refer to target date funds as ‘target dated’ funds. These types of investments rely on portfolio construction techniques to decide what to own based on decades ...

Read More »Five tips for buying your first home

Low interest rates and a desire for more space as COVID-19 led people to spend more time at home are boosting demand for homeownership. According to the National Association of Realtors, home ...

Read More »Nearly 1/3 of investors 65+ sold at the stock market bottom

Typically when you fail to plan, you are planning to fail, and that applies to the stock market. It’s best to have a plan before trouble comes, rather than make emotional decisions ...

Read More »What the proposed $6 trillion Biden budget means for your future

History will not remember President Biden for his frugality but it may for his budget. The president has already signed into law a massive multi-trillion-dollar “COVID” stimulus spending package and proposed trillions ...

Read More »Home sales dip as uncertainty grows over taxes, spending

Is the 4-year housing boom coming to an end? That possibility has some worried as home sales fell more than expected in February and the Biden administration moves forward with a massive ...

Read More »The new $15.7 billion tax on retirement accounts

We have a saying around our office that retirees are one of the highest and most unfairly taxed groups out there, and with the recent passage of the SECURE Act things are ...

Read More »Don’t play politics with your portfolio

Did the outcome of the election make you really happy and excited? Or did it leave you concerned, especially when it comes to your investments? Either way, you shouldn’t play politics with ...

Read More »How low can interest rates go?

Looking back to the start of the century, interest rates have been in decline. Back then the Aggregate Bond Index was paying over 7%. Today? Just 1%. This means in order for ...

Read More »America’s housing market on verge of post-pandemic boom say economists

There’s more good news concerning the America’s comeback from the coronavirus shut-down. A Reuters poll reveals that the nation’s housing market is expected to weather the pandemic and stage a solid rebound this year ...

Read More »Americans pay their credit card all wrong

What’s the best way to pay down credit card debt? LaTisha Styles, Millennial Finance Expert and Founder of Financial Success Media, LLC, outlines two popular strategies. “In the first way,” says Styles, ...

Read More » Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community