Need some financial advice? Debt and Income Crisis? Pay off the house first? Check cashing? Taxes? Check out what folks are asking Dave Ramsey.

Dear Dave,

I bring home $4,100 a month in military disability pay and Social Security combined. My wife brings home an additional $2,000 each month. Should we base our emergency fund level on her income only, since mine is guaranteed?

Lewis

Dear Lewis,

Your emergency fund shouldn’t be based on income. I recommend folks have three to six months of household expenses set aside in an emergency fund. What would it take to operate your household for that length of time if one or both of your incomes disappeared?

I don’t anticipate your income stopping, Lewis. But income loss isn’t the only thing you’re guarding against with an emergency fund. You’re also guarding against things like an illness in the family, if the transmission in the car goes out, or your home’s heating and cooling unit needs to be replaced. There are many more crises that can come upon a family other than a loss of income.

I don’t mind if you two lean toward the three-month side of expenses, since your income is pretty stable. But always remember, an emergency fund should contain three to six months of expenses, not income.

Thank you for your service, sir.

—Dave

What happens to the debt?

Dear Dave,

I’ve started your personal finance course in high school, so I’m asking this for the entire class. What happens to your debt if you pass away with no relatives or heirs to take responsibility for what you owed?

Elizabeth

Dear Elizabeth,

In many cases it simply does not get paid. Relatives or heirs of the deceased are not responsible for a friend or family member’s debt, except in cases where they have been a co-signer on that debt.

Let’s say someone’s parents died, and at the time of their death they had $100,000 in debt in their names only. The only way that debt will be paid is if they owned enough stuff — if they had enough in the way of assets — to pay the debt. If they owned a $200,000 home, the house would have to be sold in order to pay the debts. Their estate would be the only thing standing good for the debt. If they owned nothing, and had no co-signers on any of the debt, the creditor would not get paid. The bank lost that money.

Elizabeth, I hope that helped. Please tell your teacher I said thank you for leading the class!

—Dave

Stand up to them

Dear Dave,

A debt collection agency started calling my office a few weeks ago. I gave them an initial payment, and made an agreement to pay off the debt in monthly installments. This morning, they started calling me at my office again wanting payment. Can I legally demand they not call me at my place of employment?

James

Dear James,

Absolutely! You have a legal and moral obligation to pay your debts, and I’m glad this is something you recognize. But collectors have rules they must follow. They’re governed by law just like everyone else.

Be certain to keep your end of the agreement. Make your payments on time, or early, whenever possible. Then, if they call you at work again, remind them of your initial payment and the terms of the agreement already in place. Be polite, but firm, and demand that they never call you at your office again.

In addition, send them a certified letter, return receipt requested, so you’ll have proof you sent the letter and they received it. In the letter, let them know that — according to guidelines set forth in the Federal Fair Debt Collection Practices Act — you are demanding they not call you at your office again.

If they call you there after receiving this formal demand to stop, they’ll be in violation of federal law. If that happens, let them know you’ll talk to a lawyer and sue them.

—Dave

Laptop dilemma

Dear Dave,

My husband and I are just starting Baby Step 1 of your plan. Prior to this, we told my two nephews we would buy them laptop computers for college. They don’t get a lot of encouragement or support from their immediate family, so we try to help them when we can. Should we go ahead and honor this commitment, postpone getting our starter emergency fund in place, and possibly take on a little more debt, or bow out of the agreement?

Lisa

Dear Lisa,

Well, it’s difficult to be generous when you’re broke. You don’t even have $1,000 to your names, and you’re going to buy two laptops? I don’t know how much debt you have, or what your household income is, but I do know neither of you have managed your money very well in the past.

If you make $50,000 a year, and you have $70,000 in debt, you should sincerely and apologetically bow out. Explain that you made a big mistake, and just be honest about why you can’t provide the laptops. If you make $200,000 a year, but you’ve just been incredibly silly and lazy with your money, you should buy the laptops and then get serious about growing up and getting control of your finances.

Don’t make promises, financial or otherwise, you can’t keep. I know this is a tough, embarrassing situation, but it’s what I would do if I were in your shoes.

—Dave

First, lay a solid foundation

Dear Dave,

When is it okay to have a little fun, and buy things you want, when you’re following the Baby Steps plan?

Kaitlin

Dear Kaitlin,

The time for a little fun is after you’ve completed the first three Baby Steps. Baby Step 1 is saving $1,000 for a beginner emergency fund. Baby Step 2 is paying off all debt, except for your home. And Baby Step 3 means you go back and add to your emergency fund until you have three to six months of expenses set aside.

Once you’re debt-free except for your home — and you have your emergency fund completed — you’ve laid a solid, financial foundation for your life. That’s when you can have a little fun and spend some money on a vacation, new furniture, or something like that.

Children think about their immediate wants and do what feels good. Adults, on the other hand, devise smart, logical plans, and stick to them. I want you to have a great life, but you have to put in some hard work and say “no” to yourself sometimes in order to attain that great life!

—Dave

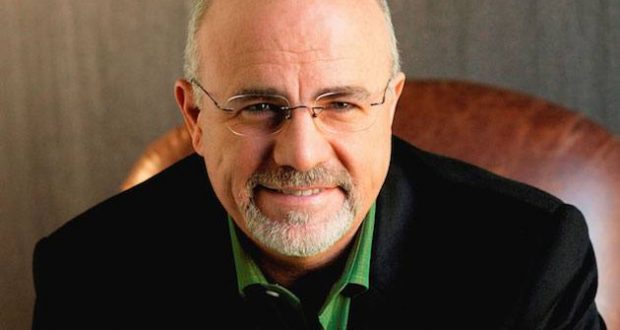

- Dave Ramsey is CEO of Ramsey Solutions. He has authored seven best-selling books, including The Total Money Makeover. The Dave Ramsey Showis heard by more than 13 million listeners each week on 585 radio stations and multiple digital platforms. Follow Dave on the web at daveramsey.com and on Twitter at @DaveRamsey.

Dave Says: Postpone the Marriage?

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community