“Nowhere is a working model for reform more evident than in Kansas”

Though Kansas is facing some temporary budget shortfalls in the next year or two, some around the country still think Gov. Brownback has the state on the right track.

A recent article on Forbes’ website by Rex Sinquefield states that “The 21st-century path to state economic prosperity, increased wages at every income level, employer re-investment, and job creation is in fact pretty straightforward. It is not a matter of wealth redistribution; it is a matter of wealth creation. It is not about slicing up a shrinking pie; it is about creating a bigger pie through economic expansion.

The pro-growth policy path is clear: cut income taxes on small business and their workers; broaden the sales tax base; wipe out corporate loopholes and cronyism that come in the form of tax breaks for favored industries; and provide sales tax rebates or ‘pre-bates’ to low-income households. When states grow, property taxes and sales taxes are multiplied by a growing gross state product, which in turn increases government revenue and its ability to provide more social services.”

This pretty well describes the track that Brownback and the legislature have put Kansas on with changes made in the last couple of years.

The Forbes article goes on to say that “Nowhere is a working model for reform more evident than in Kansas, where in 2012 and 2013 Governor Sam Brownback boldly eliminated small business pass-through income taxes and reduced individual tax rates. Kansas’ economy is driven by small business, as are all states’, and an income tax reduction will prove to be a great catalyst for attracting and growing small business.”

Brownback himself seems committed to the strategy.

“We will continue to reduce the income tax burden on our families and reward productivity,” Brownback stated recently. “Transitioning to consumption taxes allows Kansans more freedom to determine their spending and reinforce the principle that the family budget is more important than the governmental budget.”

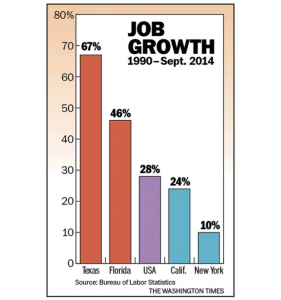

History has shown that reducing federal income tax rates leads to greater prosperity for all, and that the same holds true for state tax policy. Low- and no-income tax states outperform high income tax states across all measures of economic prosperity. The accompanying chart compares the rate of job creation in the no-income tax states of Texas and Florida with California and New York, where the state income tax rates are among the nation’s highest.

Though the transformation may be good for the state, Brownback had the misfortune to be elected in the worst possible scenario – a nationwide Great Recession. Thus, the transition has been much more difficult than it would normally have been. States like Texas that started the transition years ago have a leg up on Kansas, and are already reaping the benefits, even during the recession, as the chart shows.

If Kansas can continue to follow through with the transition and prosper in a similar fashion in coming years, that will be Brownback’s legacy.

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community