Earlier this month, the U.S. Internal Revenue Service (IRS) published its 2022 Data Book, a massive collection of filing data, compliance activities, and other statistics covering the nation’s tax base. The 82-page document contains several interesting facts about religious, charitable, and similar organizations—the largest subcategory of tax-exempt nonprofits.

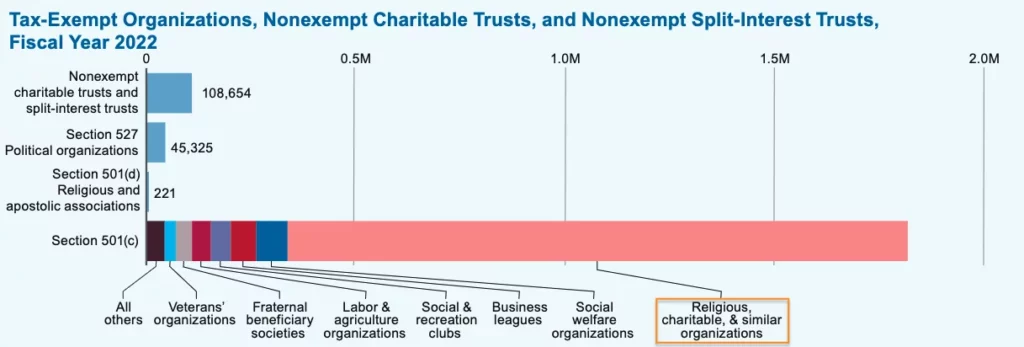

This share of the nonprofit universe has steadily grown over the decades, from around 322,800 in 1982 to 546,100 in 1992 to 909,500 in 2002 to 1 million in 2012. Today, the figure stands at 1.48 million.

As the name implies, tax-exempt organizations don’t pay federal income taxes unless they earn money from sources outside their purpose or mission. However, most are generally required to submit informational returns in the Form 990 series. Churches are an exception to this rule, though some voluntarily file Form 990s anyway for transparency reasons.

Here are some takeaways from the latest edition regarding religious organizations, charities, ministries, and other groups falling under the tax-exempt umbrella. We’ll also compare the 2022 data to previous years’ trends.

Profile of the Tax-Exempt Base

Of the 1.97 million organizations categorized as tax-exempt in the 2022 Data Book, 1.48 million were religious, charitable, or similar organizations (including private foundations). The next-largest categories comprise over 74,700 social welfare organizations, 60,500-plus business leagues, and nearly 48,000 social/recreation clubs. Another 221 are 501(d) religious and apostolic associations, which keep a common/community treasury, work for members’ benefit, and meet other qualifications.

Perhaps unsurprisingly, many tax-exempt entities hail from the most populous states, including California (with nearly 140,000), Texas (95,913), New York (93,569), and Florida (79,621).

Tax-exempt organizations filed roughly the same number of returns as last year (1.75 million), registering a tiny decline of 0.3% from 2021. That deviates from the 26.6% increase between 2020 and 2021 and the 14.4% drop in 2019–2020. The anomaly could be tied to processing delays following the onset of the pandemic when the IRS’s offices closed. Still, this figure tends to fluctuate: Tax-exempt filings fell about 5% from 2015 to 2016 but grew by nearly 5% in 2017–2018 before dipping again by 0.8% in 2018–2019.

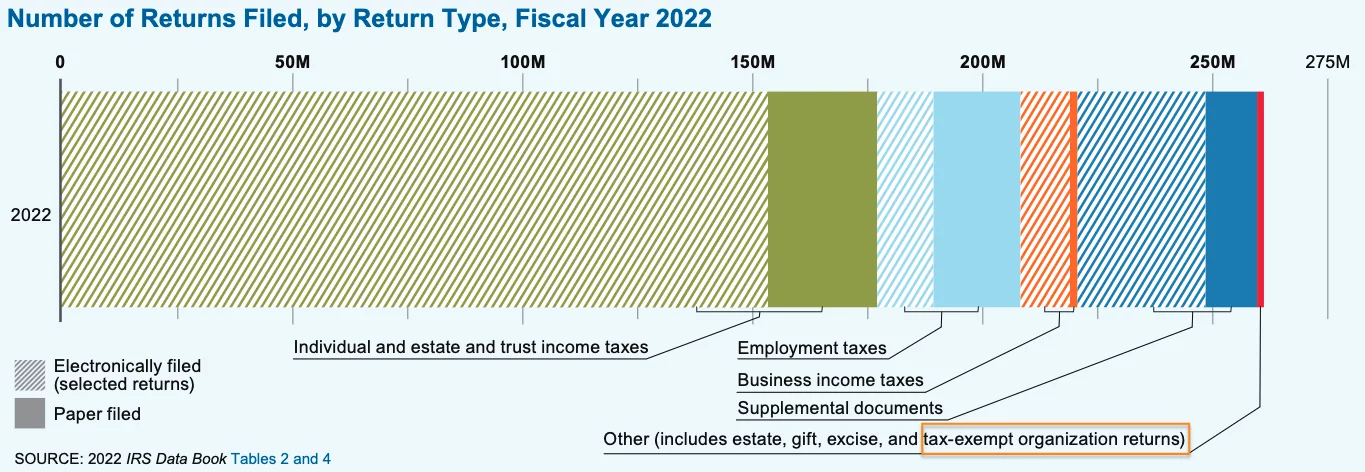

(For scale: The IRS processed 262 million total tax returns in 2022, down 2.3% from 2021. Income taxes accounted for about 189 million.)

$1.4B in Unrelated Business Income Taxes

All tax-exempt entities are required to pay taxes on unrelated business income, defined as earnings from a trade/business or that otherwise deviates from the purpose for which the organization was granted tax-exempt status. Gross collections in this category totaled $1.4 billion in 2022, a small slice of the broader business income tax label ($475.8 billion, including corporate income) and less than .05% of the $4.9 trillion in collections drawn by the IRS overall.

The $1.4 billion sum tracks with recent years’ trends, albeit a slight jump from 2021’s $1.1 billion. The year 2020 was an exception, totaling $943 million.

100K+ Newly Exempt Religious Orgs & Charities

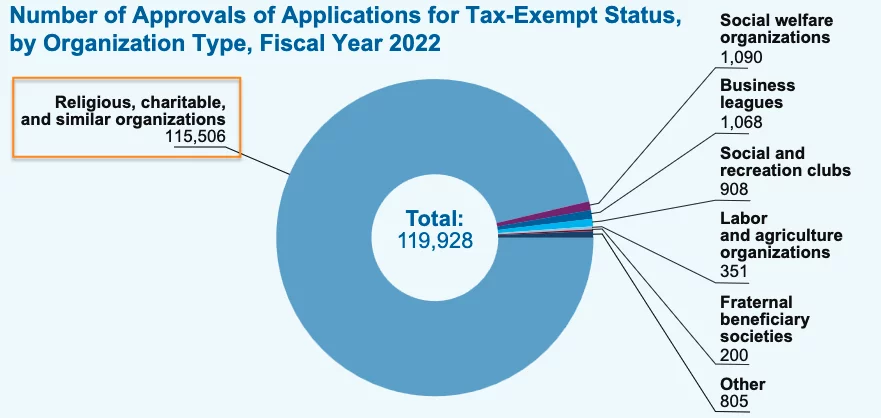

Religious, charitable, and similar organizations comprised the majority of tax-exempt application approvals last year—115,506 of 119,928 total. The IRS rejected 59 applications, a fraction of the 131,669 closed in the religious/charitable category. Another 16,104 is marked “other,” including applications withdrawn, those missing the required information, incomplete forms, correction disposals, and other miscellaneous situations.

Overall, under the broader tax-exempt umbrella, the IRS approved 87.7% of the 136,708 applications it processed. Including new determinations, the agency now recognizes nearly 2 million organizations as exempt, with over 1.8 million being 501(c) entities.

Worth noting: Specific application data is missing for 501(d) religious and apostolic associations. A footnote states this information is “not shown to avoid disclosure of information about specific organizations.” Still, the data is counted in the overall totals.

Tax-Exempt Audits Still Rare

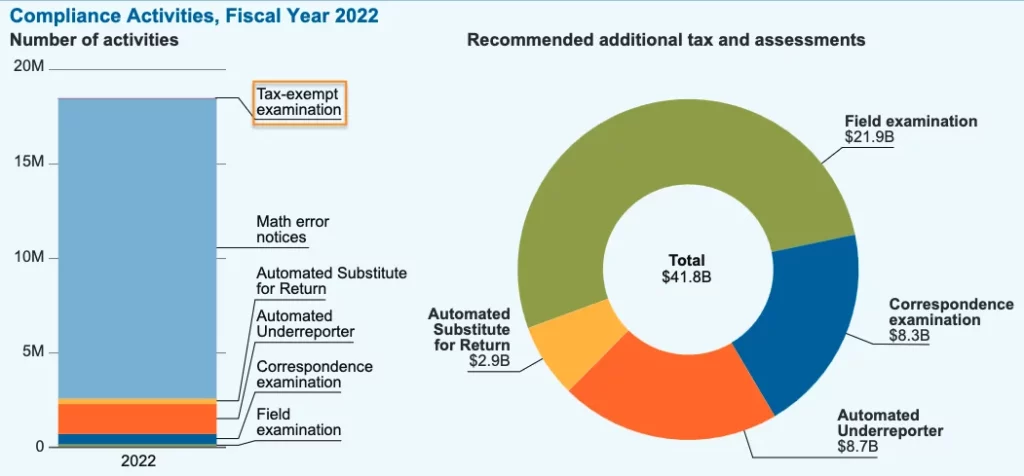

For better or worse, compliance examinations of tax-exempt filings are comparatively low, accounting for 1.3% (or 9,185) of the 708,309 audits the IRS closed last year. However, the reporting for this specific metric is broad since it also includes employee retirement plans, government entities, tax-exempt bonds, and other related returns.

Religious organizations generally file Form 990s, 990–EZs (the short-form version), and 990–Ns (electronic notices for smaller entities). These collectively accounted for 1,343 of the total examined returns.

Interestingly, the IRS examined 668 Form 990–T returns, which apply to unrelated business income taxes. That’s down from 748 in 2021 but still more than 2020’s 427.

–Shannon Cuthrell | Ministry Watch

Reprinted with permission of Ministry Watch.

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community