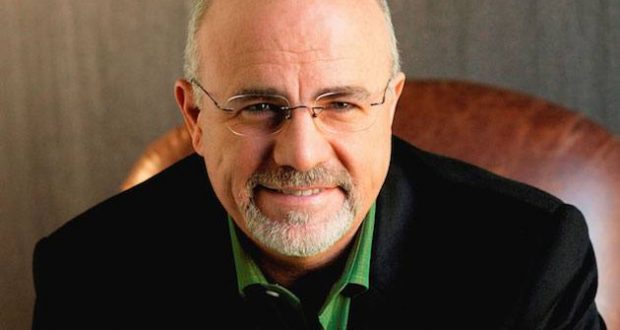

Need some financial advice? Debt and income crisis? Pay off the house mortgage first? Check cashing? Taxes? Credit Cards? Check out what folks are asking Dave Ramsey.

Long distance flip?

Dear Dave,

I’ve been following your advice for about a year. I’m almost out of debt, and I live on a budget, but looking toward the future it seems like it will be very difficult to save up for a down payment on a home. I live in Chicago, and property prices are very expensive. I have a friend in Georgia who suggested I buy a less expensive property there, then fix it up and flip it to make the money I would need for a down payment. What do you think of this idea?

Erik

Dear Erik,

When you take on the kind of work you’re talking about, you need to oversee what’s happening every step of the way. You’re working out details, keeping an eye on the crew, and having to handle a dozen other issues tied to the project. Plus, you can’t just walk up to a house or see it online, buy it, and expect to come out ahead in the deal.

People who flip houses for a living professionally eyeball dozens, sometimes hundreds, of properties to buy just one. It’s not an easy way to make money, and it’s definitely not something I’d recommend doing from a distance. In short, I wouldn’t do it, Erik. Fixing and flipping properties is a hands-on business, and trying to do it from 700 miles away would be a nightmare.

Just keep on working the budget and save as much as you can. I’d consider getting a part-time job for a while to add to the down payment fund before I’d try to fix and flip a house that far away.

—Dave

READ: How to get cheap (or free) health insurance if you retire early

Being on the same page is vital to your family’s future

Dear Dave,

My wife and I are in our 20s, and together we make about $80,000 a year. Our first baby is due in early 2022, so being debt-free has become a top priority in my mind. Right now, we have two cars. The one I drive is paid off and has a lot of miles on it, but it’s in really good shape. We still owe $30,000 on the other one, and the rest of our debt is about $90,000 in student loans. My wife puts 40,000 miles a year on the other car traveling for work. I talked to her the other day about us moving down a little in car, but she’s particular about what she drives. I even found out she has her eye on a newer vehicle that costs about $48,000. I don’t know what to do. Can you help?

Zach

Dear Zach,

Okay, let’s start slow. I’m glad you’ve seen the wisdom in getting control of your money and getting out of debt. That’s the first step toward financial peace.

Now, where the car thing is concerned, there’s not a chance in the world I’d do this. And honestly, I don’t give a crap what your wife is particular about. You guys are broke! You’re up to your eyeballs in debt, and now she’s talking about buying a $48,000 car—when you still owe $30,000 on one—then putting 40,000 miles a year on it and destroying its value quicker than you can say “fast.”

This whole idea and attitude is dumber than a rock. Absolutely not! You may have seen the light where your finances are concerned, but it sounds like your wife is still in the dark and needs to grow up some. You two should have a long, serious talk about things, and get on the same page financially—especially with a baby on the way. Your family’s future depends on it.

I hope I wasn’t unclear.

—Dave

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community