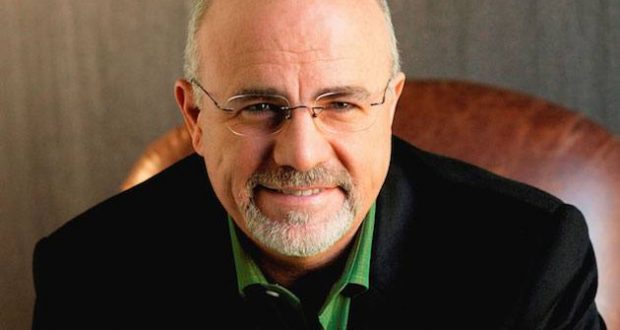

Need some financial advice? Debt and income crisis? Pay off the house mortgage first? Check cashing? Taxes? Credit Cards? Check out what folks are asking Dave Ramsey.

Dave Ramsey

Dear Dave,

Some friends recently introduced me to your ideas for handling money. I’ve got to admit a lot of it makes sense, but I’m not sure why you’re so adamant about budgeting. Can’t you get a good idea of your finances by checking your accounts and balances online regularly?

Parker

Dear Parker,

This is a great topic, especially for those who are new to the idea of getting serious about their finances and gaining control of their money. A lot of folks wonder why I’m so intense about budgeting on paper, on purpose, every month. Part of the reason is they don’t understand all the benefits—financial and otherwise—that come with giving every dollar a name.

The financial benefit is a no-brainer, so it’s the perfect place to start. I’ve been teaching people to live on a budget for many years. The reason? It never fails. People who make, and live by, a zero-based budget every month are much more likely to win with money over time. It’s not always easy when you’re first getting started, but it’s worth it.

There’s also an emotional benefit to consider. I can’t think of many things more stressful than running out of money before the end of the month. If you don’t keep a detailed accounting of every dollar that comes in, and where it goes, you’re inviting an incredible amount of fear and uncertainty into your life.

READ: Dave Says – Teachable moments are valuable at any age

Another benefit is where relationships are concerned. Money problems and fights over money are the leading causes of divorce in America. I’ve seen how proper budgeting principles can bring a sense of healing, hope, and restoration to families. During budget meetings, couples learn to talk to each other like never before. They open up, share their dreams and fears, learn how to draw boundaries, and plan for the future. And this benefit isn’t just for the married crowd. Folks who are single can develop more personal discipline, and find accountability, that has an impact on their relationships, too.

It’s tempting to think the idea of “on paper, on purpose” is nothing but a catchphrase. But it’s so much more. Budgeting is absolutely the key to gaining control of your finances!

—Dave

Don’t put your home on the line!

Dear Dave,

We’d like to start preparing for the future, but our debt is preventing us from investing for retirement. Would it be okay to use a home equity line of credit to start investing? We were thinking the eventual returns might justify doing this.

Nick

Dear Nick,

No! Never put something as important and meaningful as your home on the line just for the sake of investing. Do not borrow against your home!

I’m guessing you’re new to my way of doing things, so let’s start from the beginning. First, follow the Baby Steps. Getting $1,000 in the bank as a starter emergency fund is Baby Step 1. Next, pay off all your debts from smallest to largest—except for your home—using the debt snowball method. That’s Baby Step 2. It’s time then to revisit your emergency fund, and bulk it up to a full three to six months of expenses in Baby Step 3.

Now, it’s time to really start thinking about your future and retirement. In Baby Step 4, take 15 percent of your gross household income and start investing it for retirement. Start with your company’s 401(k) plan, up to the full employer match. Then, invest the rest into Roth IRAs. One for you, and one for your spouse, if you’re married.

Here’s the thing, Nick. Investing becomes easy at this point, because you’ve freed up your income. And that’s the most important wealth-building tool you have!

—Dave

Keep teaching

Dear Dave,

My wife and I are trying very hard to save money and pay off debt, but we’re not making progress as quickly as I had hoped. What do you think of the idea of putting a hold on our son’s allowance for the jobs he does around the house until we get into a better financial situation?

Kellen

Dear Kellen,

Kids should learn at an early age that money is connected to work. Even a child who’s in kindergarten is old enough to begin doing some age-appropriate chores around the house.

I admire your drive and determination to get out of debt, but if it were me, I wouldn’t stop the process. I would, however, stop calling it an allowance. There’s a victim mentality attached to that word. He’s doing work, and reaping the rewards.

We did this kind of thing in our home with our kids, but we called it a commission. We kept it very simple for them, and very affordable for us. If they did their jobs, they got paid. If they didn’t do their jobs, they didn’t get paid. It didn’t take long for them to make the connection.

Don’t let these teachable moments slip away, Kellen!

—Dave

Metro Voice News Celebrating Faith, Family & Community

Metro Voice News Celebrating Faith, Family & Community